Free printable savings challenges are a great tool for anyone looking to save money in a fun and engaging way. In this article, we will explore the benefits of using printable challenges, different types of challenges available, and how to create your own customized challenge.

Get ready to embark on a savings journey like never before!

Introduction to Free Printable Savings Challenges

Free printable savings challenges are a fun and effective way to save money. These challenges are designed to help individuals and families save a specific amount of money within a set period of time. By using printable challenges, you can track your progress and stay motivated throughout your savings journey.

There are several benefits to using printable challenges for saving money. First, they provide a clear and tangible goal to work towards. Whether it’s saving for a vacation, a down payment on a house, or an emergency fund, printable challenges give you a specific target to aim for.

This can help you stay focused and committed to your savings plan.

Second, printable challenges can help you develop good saving habits. By setting aside a certain amount of money each week or month, you will start to build the habit of saving regularly. This can lead to long-term financial stability and security.

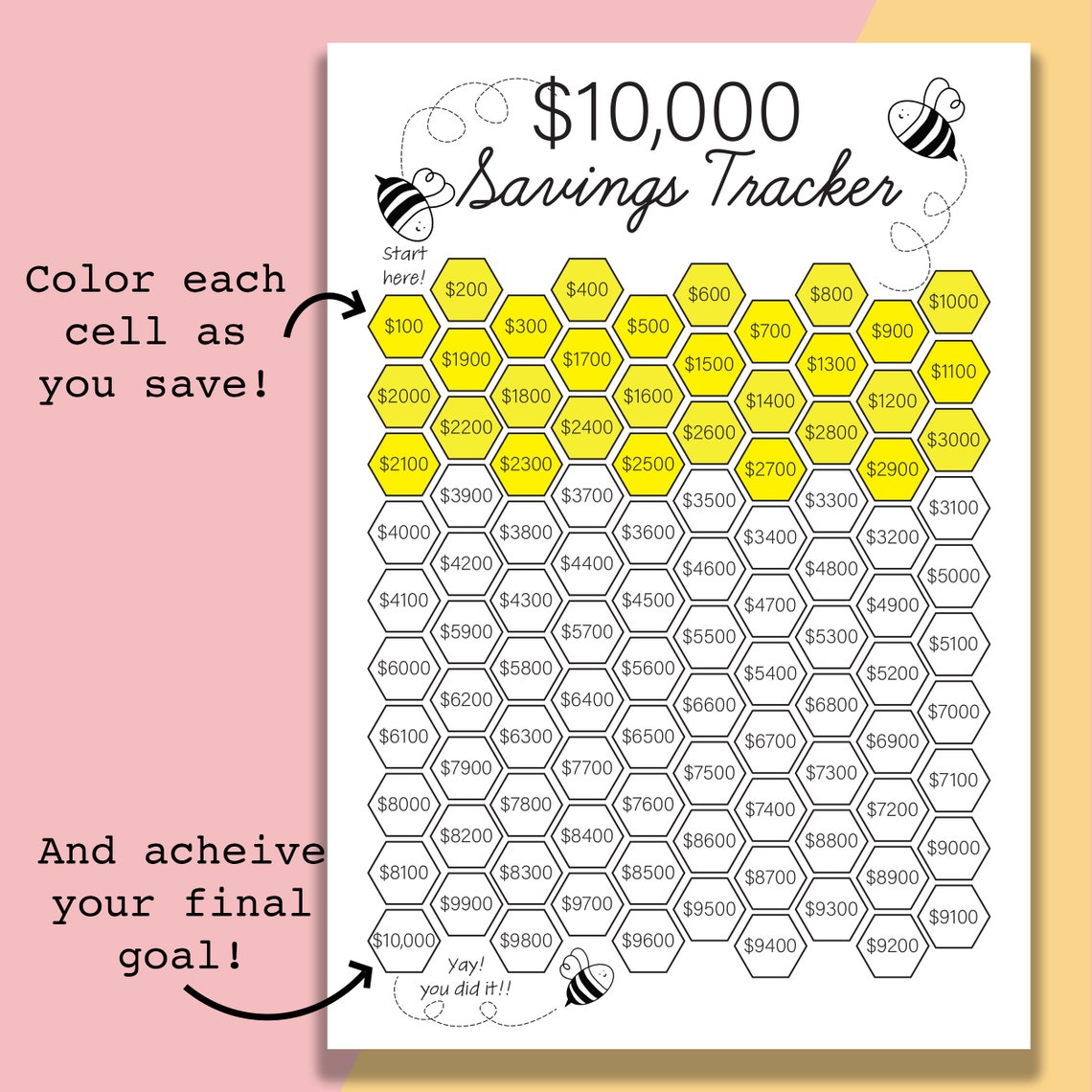

Lastly, printable challenges can be a fun and interactive way to save money. Many challenges incorporate creative and engaging methods to help you reach your savings goal. Whether it’s coloring in a chart, crossing off milestones, or using a rewards system, these challenges make saving money feel like a game.

Examples of Popular Printable Savings Challenges

There are a variety of printable savings challenges available online. Here are a few examples:

- The 52-Week Money Challenge: This challenge involves saving a specific amount of money each week for a year. The amount starts small and gradually increases over time, helping you save a significant sum by the end of the year.

- The No-Spend Challenge: This challenge encourages you to avoid unnecessary spending for a set period of time. By cutting out non-essential purchases, you can save a substantial amount of money.

- The Envelope System Challenge: This challenge involves using the envelope system to budget and save money. You allocate a certain amount of cash to different categories, such as groceries, entertainment, and transportation, and once the money in each envelope is gone, you cannot spend any more in that category.

These are just a few examples of the many printable savings challenges available. You can choose a challenge that aligns with your savings goals and personal preferences.

If you’re looking for a hands-on activity that will engage your child’s fine motor skills and creativity, why not try some cut and paste printable ? These printable worksheets provide a fun way for kids to practice cutting and pasting while creating their own artwork.

They can cut out shapes, pictures, or letters and glue them onto a blank canvas to make their own unique creations. Not only is this activity enjoyable, but it also helps develop hand-eye coordination and spatial awareness. So, grab some scissors, glue, and paper, and let your child’s imagination soar!

Types of Free Printable Savings Challenges

When it comes to free printable savings challenges, there are various types available to help you achieve your financial goals. Each type has its own goals and requirements, so it’s important to choose the right one based on your individual needs and objectives.

Let’s explore some of the different types of printable savings challenges:

1. 30-Day Money-Saving Challenge

The 30-day money-saving challenge is a popular option for those looking to build up their savings over a month. The goal of this challenge is to save a certain amount of money each day for 30 days. The challenge typically starts with smaller amounts at the beginning and gradually increases as the days go on.

By the end of the challenge, you would have saved a significant sum of money.

Requirements: Commitment to saving a specific amount of money each day for 30 days and tracking your progress.

Tips: Start with smaller amounts if you find it difficult to save larger sums. Use a printable tracker to monitor your daily savings and stay motivated throughout the challenge.

2. Weekly Savings Challenge

The weekly savings challenge is a longer-term option that spans over the course of a year. Instead of saving money daily, this challenge focuses on saving a fixed amount each week. The amount can remain consistent or increase gradually depending on your preference.

By the end of the year, you would have accumulated a significant sum of money.

Requirements: Commitment to saving a specific amount of money each week and tracking your progress.

Looking for some fun and creative activities to do with your kids this spring? Check out these free printable coloring pages spring ! Not only are they a great way to keep your children entertained, but they also allow them to express their creativity and explore different colors.

From flowers to butterflies to cute animals, these coloring pages capture the essence of spring and will surely bring a smile to your child’s face. Simply print them out and let the coloring adventure begin!

Tips: Set a realistic weekly savings goal based on your income and expenses. Use a printable savings tracker to keep track of your progress and celebrate milestones along the way.

3. Vacation Savings Challenge

The vacation savings challenge is perfect for those who have a specific vacation or travel goal in mind. This challenge focuses on saving a predetermined amount of money specifically for your dream vacation. It allows you to track your progress and ensure you have enough funds to enjoy your well-deserved getaway.

Requirements: Commitment to saving a specific amount of money each month or week, depending on the duration of your savings goal.

Tips: Determine the total cost of your vacation and set a realistic savings goal based on your desired travel dates. Use a printable vacation savings tracker to stay on top of your savings and make adjustments if needed.

4. Debt Payoff Challenge

The debt payoff challenge is designed for individuals who want to prioritize paying off their debts. This challenge focuses on allocating a specific amount of money towards debt repayment each month. It helps you track your progress and stay motivated as you work towards becoming debt-free.

Requirements: Commitment to allocating a specific amount of money towards debt repayment each month and tracking your progress.

Tips: Start by organizing your debts and determining the order in which you want to pay them off. Use a printable debt payoff tracker to monitor your progress and celebrate each milestone along the way.

5. Emergency Fund Challenge

The emergency fund challenge is ideal for those who want to build up a financial safety net. The goal of this challenge is to save a specific amount of money in an emergency fund over a certain period of time.

It helps you prepare for unexpected expenses and financial emergencies.

Requirements: Commitment to saving a specific amount of money each month until you reach your desired emergency fund goal.

Tips: Determine your desired emergency fund amount based on your expenses and financial obligations. Use a printable emergency fund tracker to monitor your progress and adjust your savings goals if necessary.

Creating Your Own Free Printable Savings Challenge

Creating a customized printable savings challenge can be a fun and effective way to motivate yourself to save money. By designing a challenge that suits your personal preferences and financial goals, you can increase your chances of sticking to the savings plan.

Here are the steps to design your own free printable savings challenge:

Setting Realistic Goals and Milestones

Before starting to design your savings challenge, it is important to set realistic goals and milestones. This involves determining the amount of money you want to save and the timeframe in which you want to achieve it. Setting achievable goals will help you stay motivated and track your progress effectively.

- Start by assessing your current financial situation and identifying how much you can realistically save each month.

- Consider your short-term and long-term financial goals. Do you want to save for a specific purchase or an emergency fund?

- Break down your overall savings goal into smaller milestones. For example, if your goal is to save $1,000 in six months, set a milestone of saving $500 in three months.

Creative Ideas for Designing Printable Challenges

Designing a visually appealing printable challenge can make the process more enjoyable and engaging. Here are some creative ideas to consider:

- Themed Challenges: Create a savings challenge that aligns with your interests or hobbies. For example, if you love traveling, design a challenge where you save a certain amount of money each week and label it as your “Travel Fund.”

- Visual Trackers: Use visual elements such as progress bars, charts, or coloring sheets to track your savings journey. This can help you visualize your progress and stay motivated.

- Reward System: Incorporate a reward system into your savings challenge. For every milestone or goal achieved, treat yourself to a small reward. This can serve as an additional motivation to stick to your savings plan.

Remember, the key to designing an effective savings challenge is to make it enjoyable and tailored to your individual preferences. By setting realistic goals and incorporating creative elements, you can increase your chances of successfully saving money.

Using Free Printable Savings Challenges Effectively

When it comes to using free printable savings challenges, it’s important to have strategies in place to stay motivated and committed to the challenge. Additionally, tracking progress and celebrating milestones can help you stay on track and feel accomplished. Here are some tips to effectively use free printable savings challenges:

Staying Motivated and Committed

1. Set clear goals: Before starting the challenge, determine why you are saving and what you hope to achieve. Whether it’s for a vacation, emergency fund, or debt repayment, having a clear goal in mind can keep you motivated.

2. Break it down: Large savings goals can be overwhelming. Break them down into smaller, achievable milestones. This way, you can celebrate each milestone and stay motivated along the way.

3. Find an accountability partner: Share your savings challenge with a friend or family member who can hold you accountable. Check in regularly to discuss progress and offer support.

4. Reward yourself: Alongside your milestones, plan small rewards for yourself. These rewards can help you stay motivated and make the savings journey more enjoyable.

5. Stay positive: Saving money can be challenging at times, but it’s important to stay positive and focus on your progress. Remind yourself of the benefits of saving and the long-term goals you are working towards.

Tracking Progress and Celebrating Milestones

1. Use a savings tracker: Utilize a printable savings tracker or create your own to visually see your progress. Update it regularly to stay motivated and keep track of how much you’ve saved.

2. Celebrate milestones: When you reach a savings milestone, take time to celebrate your achievement. Treat yourself to something small or have a mini celebration to acknowledge your progress.

3. Share your success: Don’t be afraid to share your savings journey with others. Sharing your progress and milestones can help inspire others and create a supportive community.

4. Reflect and adjust: Regularly evaluate your savings plan and adjust if needed. Life circumstances may change, and it’s important to be flexible and adapt your savings goals accordingly.

Overcoming Challenges and Adjusting the Savings Plan

1. Identify obstacles: Recognize any challenges that may arise during your savings journey. Whether it’s unexpected expenses or a decrease in income, identifying obstacles can help you develop strategies to overcome them.

2. Create a contingency plan: Have a backup plan in place for unexpected situations. This can include creating an emergency fund or having alternative sources of income.

3. Seek support: If you’re facing difficulties, don’t hesitate to seek support from financial advisors, online communities, or friends and family. They may offer valuable advice and guidance to help you overcome challenges.

4. Adjust the savings plan: If your current savings plan becomes unattainable or no longer aligns with your goals, don’t be afraid to adjust it. Make necessary changes to ensure it remains realistic and achievable.

Remember, using free printable savings challenges effectively requires commitment, motivation, and flexibility. By implementing these strategies and tips, you can maximize your savings potential and achieve your financial goals.

Resources for Free Printable Savings Challenges

When it comes to finding free printable savings challenges, there are several websites and platforms that offer a variety of options. These resources can help you stay motivated and track your progress as you work towards your savings goals. Here are some reliable sources where you can find free printable savings challenges:

Websites and Platforms

1. The Simple Dollar : The Simple Dollar offers a printable 52-week money challenge that helps you save $1,000 over the course of a year. They also provide other printable challenges for different savings goals.

2. Savings.com : Savings.com provides a variety of printable money challenges, ranging from weekly and monthly challenges to challenges for specific savings goals like a vacation or a down payment on a house.

3. Money Crashers : Money Crashers offers a collection of 30-day money saving challenges that you can download and print. These challenges are designed to help you save money on specific areas of your budget.

Features and Variety of Challenges

The websites and platforms mentioned above offer a wide range of features and challenges to cater to different preferences and savings goals. Some common features you can expect to find include:

- Weekly or monthly challenges

- Challenges with specific savings goals

- Challenges tailored to different budget areas (e.g., groceries, entertainment, transportation)

- Printable trackers to help you monitor your progress

- Tips and strategies to maximize your savings

With the variety of challenges available, you can choose the ones that align with your savings goals and personal preferences.

Recommendations for Reliable Sources

While there are many websites and platforms that offer free printable savings challenges, it’s important to choose reliable sources. Here are some recommendations:

- Stick to reputable personal finance websites and blogs.

- Look for challenges that have been created by financial experts or professionals.

- Read reviews or user feedback to gauge the effectiveness and reliability of the challenges.

- Consider the credibility and reputation of the website or platform offering the challenges.

By selecting reliable sources, you can ensure that the challenges you use are trustworthy and effective in helping you achieve your savings goals.

Success Stories and Testimonials

![]()

Printable savings challenges have helped numerous individuals achieve their savings goals and improve their financial habits. Here are some success stories and testimonials from users who found printable challenges helpful in their savings journey:

Success Story 1: Sarah’s Debt-Free Journey

Sarah, a young professional, was struggling with credit card debt and wanted to become debt-free. She came across a printable savings challenge that encouraged her to save a certain amount each week. Sarah decided to give it a try and started small, saving $10 per week.

As the weeks went by, she gradually increased her savings amount.

After a year of following the printable savings challenge, Sarah successfully paid off her credit card debt and became debt-free. The challenge helped her stay motivated and disciplined with her savings, and she is now more conscious of her spending habits.

Success Story 2: John’s Emergency Fund

John, a father of two, wanted to create an emergency fund to provide financial security for his family. He found a printable savings challenge that focused on building an emergency fund over the course of a year. John started by saving $25 per week and adjusted his budget to make it possible.

By the end of the year, John had successfully saved $1,300, which gave him peace of mind knowing that his family was financially prepared for unexpected expenses. The printable savings challenge helped John develop a habit of saving regularly and taught him the importance of having an emergency fund.

Testimonial 1: Emily’s Financial Mindset Shift

“Using printable savings challenges has completely changed my financial mindset. Before, I never paid much attention to my savings and would often spend money impulsively. But with the help of these challenges, I started setting specific savings goals and tracking my progress. It’s amazing how much a simple printable can motivate and inspire you to save!”

Emily

Testimonial 2: Mark’s Savings Success

“I’ve always struggled with saving money, but printable savings challenges have been a game-changer for me. The structured approach and clear goals provided by these challenges have helped me stay focused and disciplined. I started with small savings targets and gradually increased them, and now I’ve built a solid savings habit. I highly recommend printable savings challenges to anyone looking to improve their financial situation.”

Mark

Additional Tips and Tricks for Saving Money

Saving money is an essential skill that can help you achieve financial stability and reach your financial goals. In addition to using free printable savings challenges, here are some additional tips and tricks to help you save even more money.

1. Cut Down on Unnecessary Expenses

Identify areas where you can reduce your spending and cut down on unnecessary expenses. This could include eating out less frequently, canceling unused subscriptions, or finding more affordable alternatives for everyday items.

- Plan your meals and groceries in advance to avoid impulse purchases and food waste.

- Consider buying generic brands instead of name brands for certain products.

- Comparison shop and look for discounts or deals before making a purchase.

- Avoid unnecessary shopping trips and limit your exposure to tempting sales or promotions.

2. Automate Your Savings

One effective strategy to save money is by automating your savings. Set up automatic transfers from your checking account to a separate savings account on a regular basis. This way, you won’t have to rely on willpower alone to save money.

- Start with a small amount and gradually increase the amount you save over time.

- Consider setting up different savings accounts for specific goals, such as an emergency fund or a vacation fund.

- Take advantage of apps and online tools that round up your purchases and save the spare change.

3. Track Your Expenses, Free printable savings challenges

Keeping track of your expenses is crucial for effective budgeting and managing your finances. By understanding where your money is going, you can identify areas where you can cut back and save more.

- Maintain a budget spreadsheet or use budgeting apps to track your income and expenses.

- Review your expenses regularly and look for patterns or trends.

- Identify areas where you can make adjustments and reduce spending.

4. Set Clear Financial Goals

Having clear financial goals can provide motivation and purpose for saving money. Whether it’s saving for a down payment on a house, paying off debt, or building an emergency fund, setting goals can help you stay focused and committed to saving.

- Write down your financial goals and break them down into smaller, achievable milestones.

- Track your progress regularly and celebrate your achievements along the way.

- Consider visualizing your goals by creating a vision board or using a savings goal tracker.

5. Prioritize Saving

Make saving a priority in your budget and lifestyle. By making saving a habit, you can ensure that you consistently set money aside for your future financial needs.

- Pay yourself first by allocating a portion of your income to savings before paying bills or spending on discretionary items.

- Automate your savings contributions to make it easier to stick to your savings goals.

- Look for ways to increase your income, such as taking on a side gig or freelancing.

Remember, saving money is a journey, and it requires discipline and commitment. By implementing these additional tips and tricks, you can maximize your savings and achieve your financial goals more efficiently.