Free printable check registers are the key to efficient personal finance management. In this article, we’ll explore the benefits of using these registers and how they can help you stay organized. Let’s dive in and discover how you can simplify your finances with free printable check registers.

In the following sections, we’ll discuss the different types of check registers available, how to access them, and ways to customize them to suit your needs. We’ll also share valuable tips for using check registers effectively and answer frequently asked questions to ensure you have all the information you need.

Introduction to Free Printable Check Registers

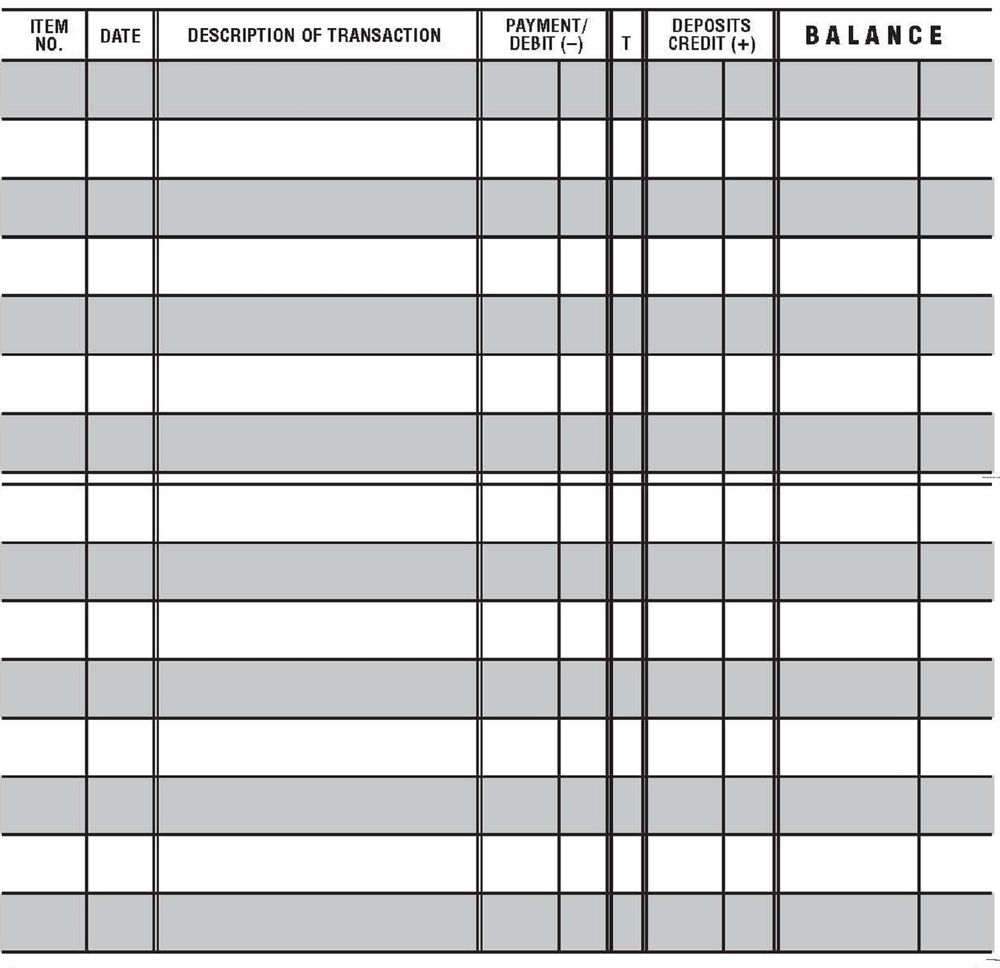

A check register is a tool used to keep track of transactions made through a checking account. It serves as a record of all deposits, withdrawals, and any other activity related to the account. Managing personal finances is essential for achieving financial goals and maintaining financial stability.

Keeping a check register helps individuals stay organized and maintain an accurate account balance.

Using a printable check register offers several benefits. Firstly, it provides a tangible and easily accessible record of financial transactions. Unlike digital or online platforms, printable check registers can be physically stored and referred to whenever needed. Additionally, printable check registers allow individuals to customize the format according to their preferences and specific needs.

In this article, we will explore the importance of check registers in managing personal finances and discuss the benefits of using printable check registers. We will also provide an overview of the article, highlighting the topics that will be covered and what readers can expect to learn.

Are you searching for a special gift for Mom? Look no further! Our all about mom printable is the perfect way to show your love and appreciation. This printable includes fun activities and heartfelt questions that will make Mom feel extra special.

Whether it’s for Mother’s Day or just because, this printable is a thoughtful and personal gift that she will treasure forever. So go ahead, download and print this printable, and make Mom’s day unforgettable!

Types of Free Printable Check Registers

When it comes to free printable check registers, there are several types available that cater to different needs and preferences. Each type has its own features and formats, offering advantages and disadvantages.

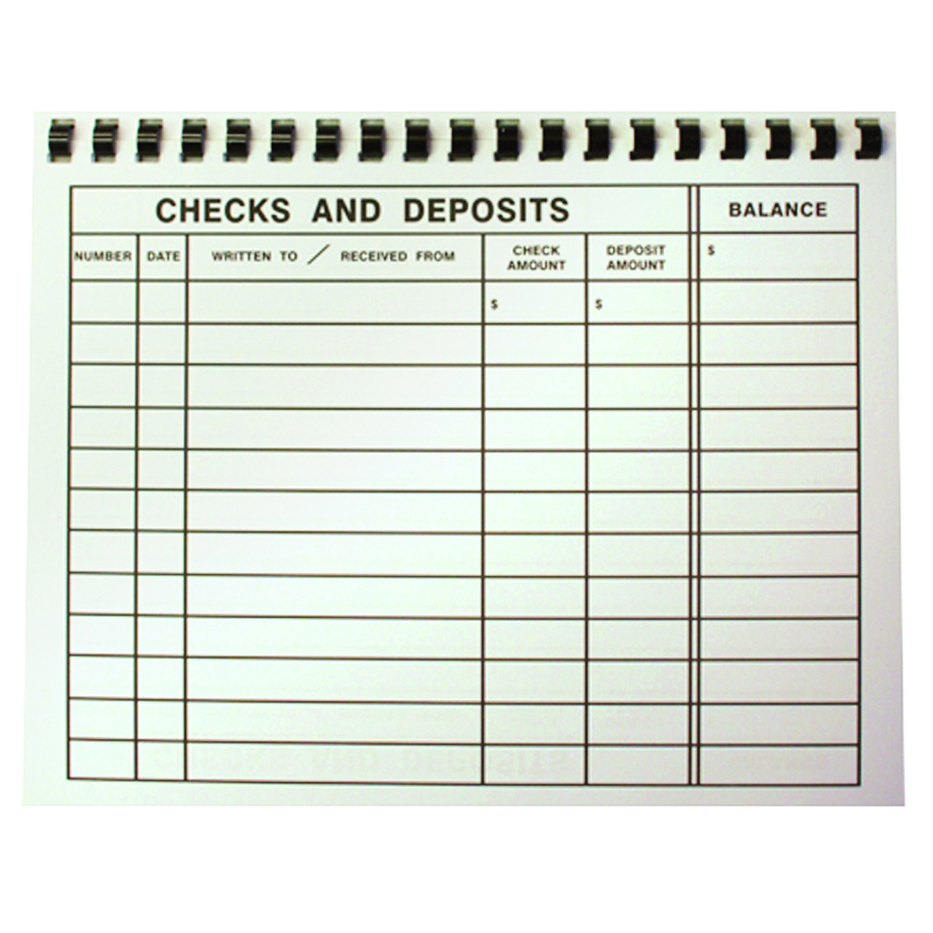

1. Basic Check Register

The basic check register is the simplest type available. It typically consists of columns for the date, check number, description, withdrawal, deposit, and balance. This type of register is suitable for individuals who prefer a straightforward and minimalistic approach to tracking their finances.

Advantages:

- Easy to use and understand

- Provides a clear overview of transactions

- Does not require advanced computer skills

Disadvantages:

- Lacks advanced features for detailed analysis

- May not be suitable for complex financial situations

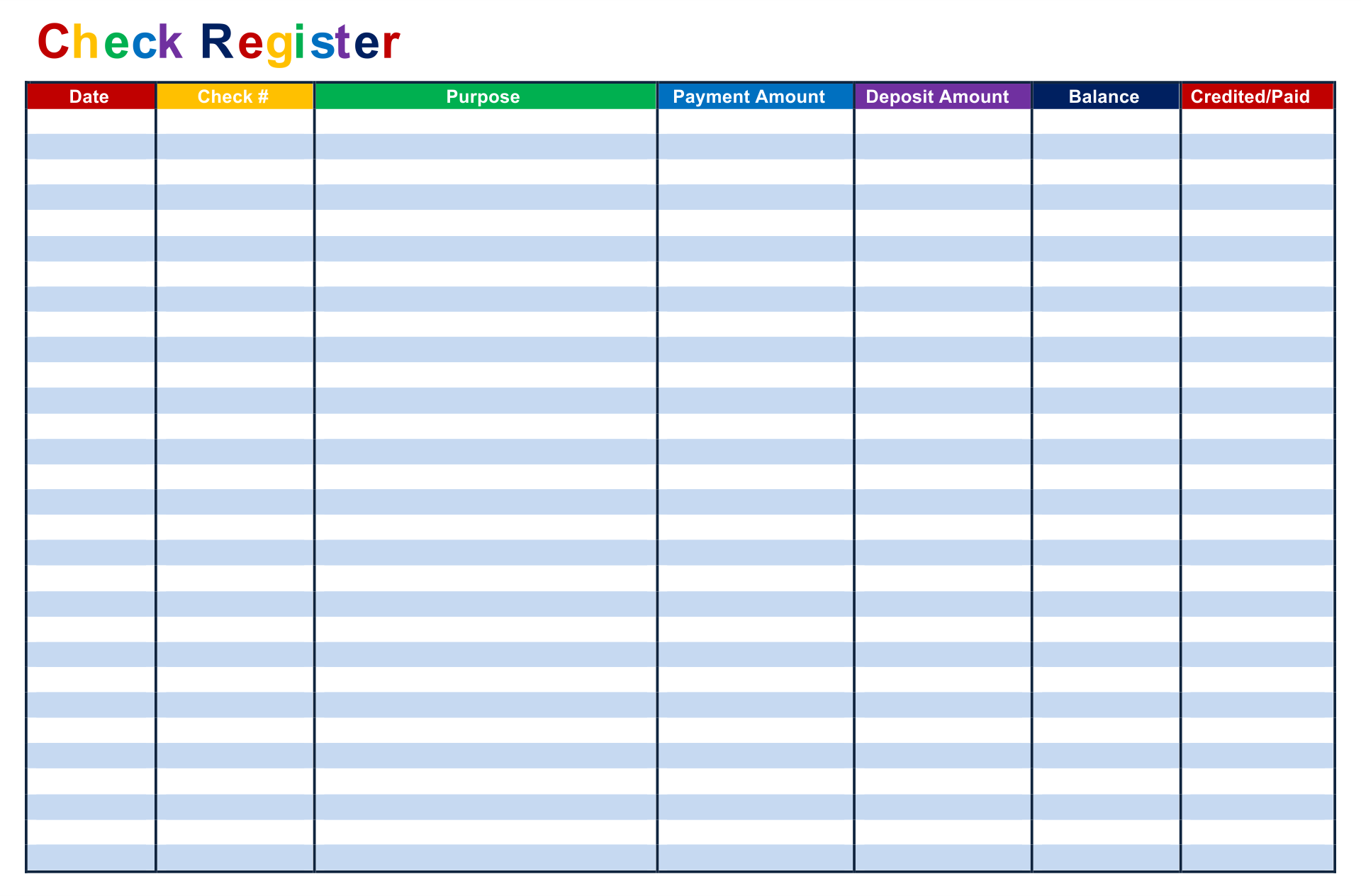

2. Detailed Check Register

The detailed check register offers more advanced features and formats compared to the basic register. It includes additional columns for categorizing transactions, such as income, expenses, and specific budget categories. This type of register is ideal for individuals who want a more comprehensive view of their finances.

Advantages:

- Allows for better categorization and organization of transactions

- Enables detailed analysis of spending habits and budgeting

- Provides a more comprehensive financial overview

Disadvantages:

- Requires more time and effort to maintain

- May be overwhelming for individuals who prefer simplicity

3. Online Check Register

An online check register is a digital version that can be accessed through a computer or mobile device. It offers the convenience of real-time updates and automatic calculations. This type of register is suitable for individuals who prefer a paperless approach or frequently need to access their financial data on the go.

If you’re looking for cute free printable coloring pages, you’ve come to the right place! Check out this amazing collection of cute free printable coloring pages that will surely bring joy to your little ones. From adorable animals to fun characters, there’s something for everyone.

Just download and print these pages, grab some crayons, and let your kids’ creativity shine!

Advantages:

- Accessible anytime and anywhere with internet connection

- Automatically calculates balances and totals

- Allows for easy searching and filtering of transactions

Disadvantages:

- Dependent on internet connection and technology

- May require subscription or payment for advanced features

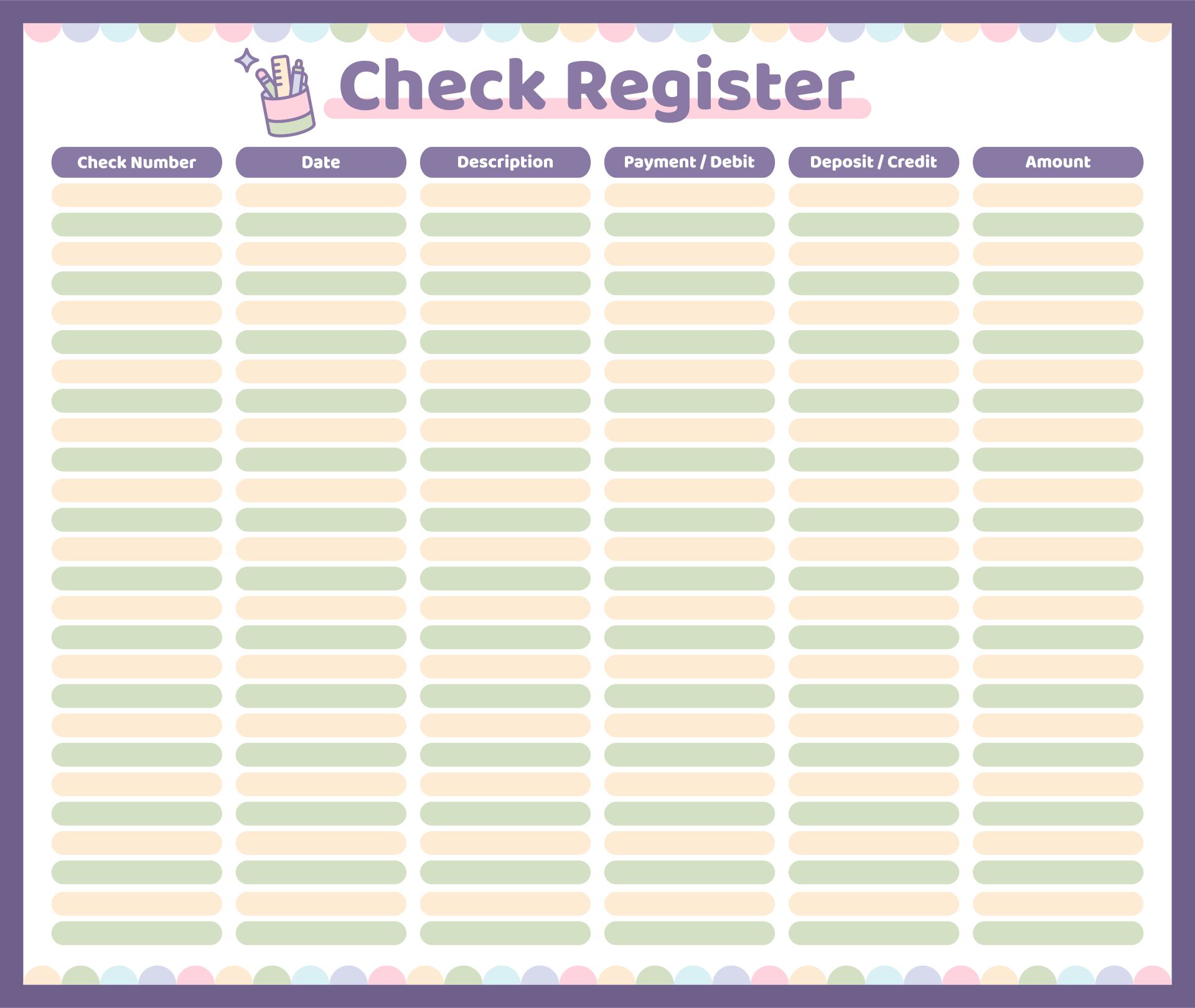

4. Customizable Check Register

A customizable check register allows users to personalize the format and columns according to their specific needs. It offers flexibility and adaptability, making it suitable for individuals with unique financial tracking requirements.

Advantages:

- Can be tailored to fit individual preferences

- Allows for tracking of specific financial goals or metrics

- Provides a personalized financial tracking experience

Disadvantages:

- May require advanced computer skills for customization

- Can be time-consuming to set up initially

With these various types of free printable check registers, individuals can choose the one that best suits their needs and preferences. Whether it’s a basic register for simplicity or a detailed register for comprehensive analysis, these tools can help individuals effectively track and manage their finances.

How to Access Free Printable Check Registers

Accessing free printable check registers is a simple and convenient way to keep track of your financial transactions. These registers can be found on various websites and online platforms that offer them for free. In this section, we will discuss some popular websites and provide step-by-step instructions on how to download and access these registers.

Websites and Online Platforms

There are several websites and online platforms where you can find free printable check registers. Some of the popular ones include:

- Website 1: This website offers a wide range of free printable check registers that you can download and print. They have different templates and designs to choose from.

- Website 2: Another website that provides free printable check registers with customizable options. You can personalize the registers according to your preferences.

- Website 3: This platform offers a collection of free printable check registers that are categorized based on their purposes. You can easily find the register that suits your needs.

Downloading and Accessing Check Registers

To download and access free printable check registers, follow these step-by-step instructions:

- Visit the website or online platform that offers the free printable check registers.

- Browse through the available options and select the register template that you prefer.

- Click on the download button or link provided for the chosen register template.

- Save the downloaded file to your computer or device.

- Locate the downloaded file and open it using a PDF viewer or a compatible software.

- Once the file is open, you can view and print the check register.

Requirements and Limitations

Accessing free printable check registers usually does not require any specific requirements. However, you may need a PDF viewer or compatible software to open and print the downloaded file. Make sure you have a printer available if you wish to have a physical copy of the register.It’s

important to note that while these registers are free to download and use, they may have certain limitations. Some platforms may require you to create an account or provide your email address to access the registers. Additionally, the templates provided may have limited customization options.Overall,

accessing free printable check registers is a convenient way to manage your finances. By following the steps Artikeld above, you can easily download and use these registers to keep track of your financial transactions.

Customizing Free Printable Check Registers

When using free printable check registers, users have the flexibility to customize the design and layout according to their preferences. Customization allows individuals to personalize their check registers and make them more visually appealing and functional. Here are some tips and suggestions for customizing check registers:

Organizing Information

Proper organization of information in a check register is crucial for easy reference and accurate record-keeping. Consider the following tips:

- Use clear and legible fonts to ensure readability.

- Allocate separate columns for different entries, such as date, check number, description, and amount.

- Consider color-coding different sections or categories for better organization.

- Include subtotals or balance calculations to keep track of the account balance.

- Leave enough space between entries to avoid clutter and facilitate writing.

Customization Options

Here are some examples of customization options that users can consider:

- Themes:Choose a theme that aligns with your personal style or preferences. It could be a minimalist design, a floral pattern, or a professional layout.

- Colors:Select a color scheme that suits your taste. You can use pastel shades for a calming effect or vibrant colors for a more energetic look.

- Headers and Footers:Add headers and footers to your check register to include important information such as your name, address, or account number.

- Graphics:Incorporate graphics or icons that represent your interests or hobbies. For example, if you love sports, you can include small sports-related images next to each entry.

- Additional Fields:Customize the columns in your check register to include additional fields that are relevant to your financial tracking needs, such as category or payment method.

Remember to strike a balance between customization and functionality. While it’s important to make your check register visually appealing, ensure that it remains easy to read and use.

Tips for Using Free Printable Check Registers Effectively

Using a check register effectively is essential for accurate financial management. Here are some best practices to help you enter and track transactions, reconcile your check register with bank statements, and effectively manage your personal finances.

Entering and Tracking Transactions

Entering transactions accurately and consistently is crucial for maintaining an up-to-date check register. Follow these tips:

- Record transactions immediately: Enter transactions into your check register as soon as you make them. This ensures that you don’t forget any transactions and helps you maintain an accurate record of your finances.

- Include all necessary details: When recording a transaction, make sure to include the date, payee, purpose, and amount. This information will be useful for reference and tracking expenses.

- Categorize transactions: Assign categories to each transaction to help you analyze your spending patterns and identify areas where you can cut back or save.

- Use separate columns for deposits and withdrawals: Differentiating between deposits and withdrawals will make it easier to calculate your account balance accurately.

Reconciling the Check Register with Bank Statements

Regularly reconciling your check register with your bank statements ensures that your records match the bank’s records. Follow these tips:

- Review bank statements promptly: When you receive your bank statement, compare it with your check register immediately. This will help you identify any discrepancies and address them in a timely manner.

- Check off cleared transactions: Mark off transactions in your check register once they have been cleared by the bank. This will help you keep track of which transactions have been processed.

- Investigate any discrepancies: If you notice any discrepancies between your check register and the bank statement, investigate the cause. It could be an error on your part or an error made by the bank. Resolving discrepancies promptly will ensure accurate financial records.

Using the Check Register to Manage and Budget Personal Finances

Your check register can be a valuable tool for managing and budgeting your personal finances. Consider the following strategies:

- Monitor your spending: Regularly review your check register to understand your spending habits. This will help you identify areas where you can cut back on expenses and save money.

- Create a budget: Use your check register to create a budget by categorizing your expenses and setting limits for each category. This will help you stay on track and achieve your financial goals.

- Track your income: In addition to recording expenses, track your income in your check register. This will give you a complete picture of your financial situation and help you make informed decisions.

- Set financial goals: Use your check register to track your progress towards financial goals, such as saving for a vacation or paying off debt. Regularly update your check register to see how close you are to achieving these goals.

By following these tips, you can make the most of your free printable check register and effectively manage your personal finances.

Frequently Asked Questions about Free Printable Check Registers

Here are some commonly asked questions about using free printable check registers:

What is a check register and why is it important?

A check register is a document used to record and track all transactions made through a checking account. It helps you keep track of your account balance, monitor your spending, and reconcile your bank statement. Keeping an accurate check register is important for maintaining financial stability and avoiding overdrafts or fraudulent activity.

How do I use a free printable check register?

To use a free printable check register, start by downloading and printing the template. Fill in the necessary details, such as the date, check number, payee, and amount for each transaction. Calculate the new balance after each transaction and update it accordingly.

Remember to regularly reconcile your check register with your bank statement to ensure accuracy.

What are the different types of free printable check registers available?

There are various types of free printable check registers available, including:

- Basic check registers: These provide a simple template for recording transactions.

- Expense-specific check registers: These are designed for tracking specific types of expenses, such as business expenses or personal expenses.

- Online check registers: These can be accessed and filled out electronically, eliminating the need for printing.

Where can I find free printable check registers?

You can find free printable check registers on various websites that offer personal finance templates and resources. Some popular sources include financial blogs, personal finance websites, and printable template websites. It’s important to ensure that the source is reputable and the template meets your specific needs.

Can I customize a free printable check register to fit my needs?

Yes, most free printable check registers can be customized to fit your specific requirements. You can modify the template by adding or removing columns, adjusting the layout, or incorporating additional fields. This allows you to tailor the check register to your personal preferences and financial tracking needs.

What tips can you provide for using free printable check registers effectively?

Here are some tips for using free printable check registers effectively:

- Be consistent: Make it a habit to record all transactions immediately to ensure accuracy.

- Double-check entries: Review each entry for accuracy before updating your check register.

- Reconcile regularly: Compare your check register with your bank statement on a regular basis to identify any discrepancies.

- Keep it organized: Store your check register in a safe place and consider using separate registers for different accounts or purposes.

- Use additional tools: Consider using financial management software or mobile apps to complement your check register and automate certain tasks.