Delve into the exciting world of the free printable 100 envelope challenge, a unique and engaging method to enhance your financial habits.

In this article, we will explore the purpose and benefits of participating in the challenge, along with practical tips on getting started, creating personalized envelopes, tracking progress, and overcoming obstacles. Get ready to revolutionize your savings game!

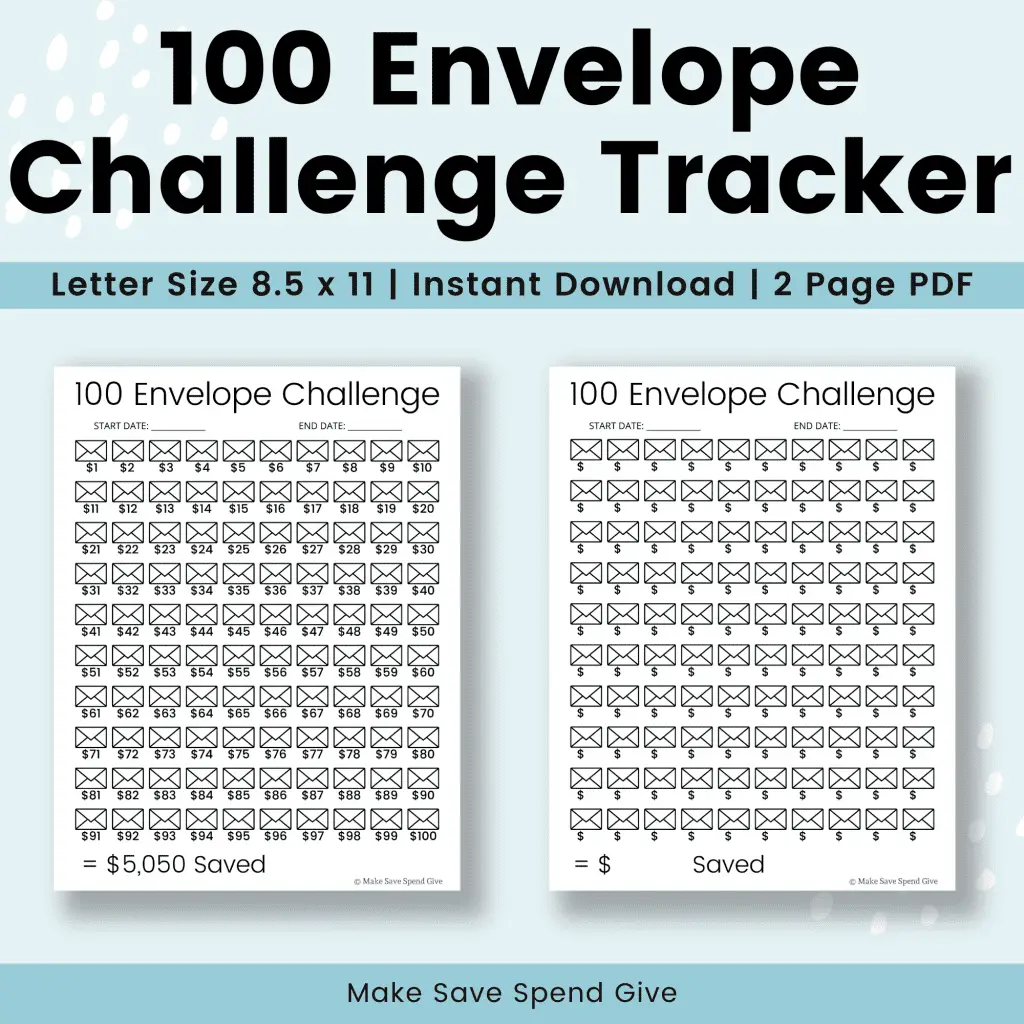

Introduction to the 100 Envelope Challenge

The 100 Envelope Challenge is a financial saving challenge where participants aim to save money by using envelopes to set aside a certain amount of cash each day. The challenge involves numbering 100 envelopes from 1 to 100 and placing a specific amount of money in each envelope corresponding to its number.The

purpose of participating in the 100 Envelope Challenge is to develop better financial habits and improve saving skills. By committing to saving a set amount of money each day, participants learn discipline, budgeting, and the importance of setting financial goals.

This challenge also helps individuals develop a habit of saving consistently and can be a great way to kickstart a savings plan.Participating in the 100 Envelope Challenge has several benefits. Firstly, it allows individuals to build an emergency fund or save for a specific financial goal.

If you’re looking for a fun and creative activity for your kids, why not try coloring pages featuring dogs? You can find a wide variety of dogs coloring pages printable on this website. From cute puppies to loyal companions, these coloring pages are sure to keep your little ones entertained.

All you need is a printer and some crayons or colored pencils. Simply download and print the pages, and let your kids’ imagination run wild. It’s a great way to spend quality time together and encourage their creativity. So why not give it a try?

By saving a small amount each day, participants can accumulate a significant sum of money over time. Additionally, this challenge helps individuals become more mindful of their spending habits and encourages them to make conscious decisions about their expenses.The 100 Envelope Challenge can also teach individuals the importance of delayed gratification.

By setting aside money each day, participants learn to resist the temptation of immediate spending and prioritize long-term financial goals. This challenge can help individuals break impulsive spending habits and develop a more thoughtful approach to managing their finances.

How the challenge can help people improve their financial habits

Participating in the 100 Envelope Challenge can have a positive impact on an individual’s financial habits. Here are some ways the challenge can help improve financial habits:

- Developing discipline: The challenge requires consistent saving, which helps individuals develop discipline in managing their finances.

- Creating a savings habit: By saving a set amount each day, participants establish a habit of saving regularly.

- Learning budgeting skills: The challenge encourages participants to allocate their money wisely and make conscious decisions about their expenses.

- Building an emergency fund: Saving money through the challenge allows individuals to build an emergency fund for unexpected expenses.

- Setting financial goals: The challenge helps individuals set and achieve financial goals by saving a specific amount each day.

The 100 Envelope Challenge provides a practical and tangible way for individuals to improve their financial habits and take control of their finances. By participating in this challenge, individuals can develop a sense of financial responsibility and work towards achieving their long-term financial goals.

If you’re into remote-controlled boats and love a good DIY project, then you should definitely check out this 3d printable rc boat . This website offers a selection of 3D printable designs for RC boats that you can make yourself.

Whether you’re a beginner or an experienced enthusiast, these designs come with instructions and templates that are easy to follow. You can choose from different styles and sizes, and customize them to your liking. So why not give it a try and start building your own RC boat today?

Getting Started with the 100 Envelope Challenge: Free Printable 100 Envelope Challenge

The 100 Envelope Challenge is a great way to save money and stay organized. Here are the steps to get started:

Step 1: Set a Budget

Before beginning the challenge, it’s important to set a budget. Determine how much money you want to save and how often you will contribute to the envelopes. This will help you stay on track and reach your savings goal.

Step 2: Choose the Right Envelopes

When selecting envelopes for the challenge, it’s important to choose ones that are durable and easy to label. Consider using envelopes with a secure closure and enough space to write the amount of money saved. You can also get creative and use colorful envelopes to make it more fun!

Step 3: Label and Organize the Envelopes

Once you have your envelopes, it’s time to label and organize them. Write the savings goal or purpose on each envelope, such as “Vacation Fund” or “Emergency Fund.” Then, assign a specific amount of money to each envelope, based on your budget.

This will help you track your progress and stay motivated.

Creating Free Printable Envelopes for the Challenge

When participating in the 100 Envelope Challenge, using free printable envelopes can be a convenient and cost-effective option. There are several advantages to using these envelopes:

- Accessibility: Free printable envelope templates are readily available online, making it easy for anyone to access and use them.

- Cost-saving: Printing envelopes at home using free templates eliminates the need to purchase pre-made envelopes, saving you money in the process.

- Customization: With free printable envelopes, you have the flexibility to customize and personalize them according to your preferences, adding a personal touch to your savings journey.

- Variety: Online resources provide a wide range of free printable envelope designs, allowing you to choose from different styles, colors, and patterns that suit your taste.

Finding Free Printable Envelope Templates

To find free printable envelope templates, you can visit various websites that offer them. Some popular resources include:

- Freepik : This website provides a collection of free envelope templates in different designs that you can download and print.

- Template.net : Template.net offers a variety of envelope templates for free, ranging from simple designs to more intricate ones.

- Pinterest : On Pinterest, you can find countless envelope templates shared by users. Simply search for “free printable envelope templates” to explore the available options.

Customizing and Personalizing the Envelopes

Once you have downloaded a free printable envelope template, you can further customize it to suit your preferences. Here are some tips:

- Choose the right paper: Select a sturdy paper that is suitable for envelopes to ensure durability.

- Add personal touches: Consider adding decorative elements such as stickers, washi tape, or hand-drawn designs to make the envelopes unique.

- Include labels or tags: You can print labels or tags with relevant information such as the envelope’s purpose or a motivational quote.

- Experiment with colors: Use colored paper or print the envelopes in different colors to add a pop of color to your savings journey.

Printing the Envelopes Correctly

Printing the envelopes correctly is crucial to ensure optimal use. Follow these tips:

- Adjust printer settings: Set the paper size and orientation correctly to match the envelope template.

- Test print: Before printing a large batch of envelopes, do a test print to ensure the layout and size are correct.

- Use high-quality ink and paper: Use ink and paper of good quality to ensure clear and vibrant prints.

- Follow folding instructions: Pay attention to the folding marks and guidelines provided in the template to achieve properly folded envelopes.

Tracking Progress and Staying Motivated

Tracking progress throughout the 100 Envelope Challenge is essential to stay motivated and committed to achieving your savings goals. It allows you to see how far you’ve come and provides a visual representation of your progress. Here are some methods and tools you can use to track your envelope usage and savings:

1. Envelope Tracking Sheet

Create a simple tracking sheet where you can record the amount of money you put into each envelope and the total savings accumulated over time. This can be done either manually on paper or using a spreadsheet on your computer or smartphone.

Having a visual representation of your savings growth can serve as a powerful motivator to keep going.

2. Savings App

Consider using a savings app that allows you to track your envelope usage and savings digitally. These apps often have features that categorize your expenses and provide insights into your spending habits. Some popular savings apps include Mint, PocketGuard, and YNAB (You Need a Budget).

3. Piggy Bank or Jar

If you prefer a more tangible way of tracking your progress, you can use a piggy bank or a jar to collect the cash from your envelopes. As the money accumulates, you’ll be able to physically see the amount grow, which can be highly motivating.

4. Visual Representations

Get creative and create visual representations of your savings progress. For example, you can use a chart or a graph to track the growth of your savings over time. Seeing the upward trend can serve as a reminder of your commitment and keep you motivated to continue the challenge.

Staying Motivated and Committed

To stay motivated and committed to the 100 Envelope Challenge, consider the following tips:

Set achievable goals

Break down your savings goal into smaller milestones that are easier to achieve. Celebrating these small victories will keep you motivated along the way.

Reflect on your why

Remind yourself why you started the challenge in the first place. Whether it’s to save for a specific goal or to improve your financial habits, keeping your why in mind will help you stay focused.

Find an accountability partner

Share your progress and goals with a friend or family member who can hold you accountable. Having someone to share your successes and challenges with can provide the support and encouragement you need.

Celebrate milestones

When you reach a significant milestone or achieve a savings goal, celebrate your accomplishment. Treat yourself to a small reward or do something that brings you joy. This will reinforce the positive behavior and motivate you to continue.

Stay disciplined

Stick to your budget and resist the temptation to dip into your envelope savings for non-essential expenses. Remember that every dollar you save brings you closer to your financial goals.

Success Stories

Many individuals have successfully completed the 100 Envelope Challenge and achieved their savings goals. For example, Sarah, a single mother of two, was able to save enough money from the challenge to take her children on a vacation they had been dreaming of.

John, a recent college graduate, used the challenge to save up for a down payment on his first home. These success stories are a testament to the effectiveness of the challenge and the power of staying motivated and committed.Remember, tracking your progress and staying motivated are crucial elements of the 100 Envelope Challenge.

By using the right tools, setting achievable goals, and staying disciplined, you can successfully complete the challenge and achieve your financial goals.

Overcoming Challenges and Adjusting Strategies

The 100 Envelope Challenge, like any financial challenge, can come with its own set of challenges. However, with the right strategies and adjustments, these challenges can be overcome. Here are some common challenges people may face during the 100 Envelope Challenge and tips for overcoming them.

1. Temptation to Spend, Free printable 100 envelope challenge

- Use visual reminders: Place the envelopes in a visible location as a constant reminder of your goal.

- Practice self-control: Develop discipline and resist the urge to spend money from the envelopes for purposes other than the designated goal.

- Find accountability partners: Share your challenge with a friend or family member who can help keep you accountable and motivated.

- Create a budget: Establish a budget that aligns with your financial goals and ensures that you have enough funds for necessary expenses.

2. Irregular Income

- Adapt the challenge: Instead of using envelopes, consider using a separate bank account or virtual envelopes in a budgeting app to allocate funds.

- Set percentage goals: Allocate a percentage of your income towards the challenge instead of a fixed amount.

- Save windfalls: Whenever you receive unexpected income or bonuses, allocate a portion towards the challenge.

3. Unexpected Expenses

- Create an emergency fund: Set aside a portion of your income for unexpected expenses to avoid dipping into your challenge funds.

- Adjust envelope allocations: If a significant unexpected expense arises, temporarily adjust the allocations of your envelopes to accommodate the expense.

- Pause and resume: Pause the challenge temporarily if necessary and resume once the unexpected expense has been addressed.

4. Lack of Motivation

- Break it down: Divide the challenge into smaller milestones to make it feel more achievable and celebrate each milestone.

- Reward yourself: Set rewards for reaching certain milestones or for achieving the overall challenge goal to stay motivated.

- Join a community: Engage with others who are also taking the 100 Envelope Challenge for support and motivation.

- Track progress visually: Use a chart or tracker to visually see your progress, which can help reignite motivation.

Alternative Approaches

If the 100 Envelope Challenge doesn’t align with your circumstances or goals, here are some alternative approaches you can consider:

- 50 Envelope Challenge: Reduce the number of envelopes to make it more manageable.

- Percentage-based Challenge: Allocate a percentage of your income towards savings or a specific financial goal.

- Time-based Challenge: Set a specific time period (e.g., 6 months) and aim to save a certain amount within that timeframe.

- Debt Repayment Challenge: Focus on paying off debt by allocating funds towards debt repayment envelopes.

Remember, the key is to find an approach that works best for you and your financial situation. Adjustments and alternatives can help tailor the challenge to fit your needs and increase the likelihood of success.

Celebrating Success and Next Steps

As you progress through the 100 Envelope Challenge and reach various milestones, it’s important to take the time to celebrate your achievements. Celebrating success not only boosts your motivation but also reinforces positive financial habits. It’s a way to acknowledge your hard work and dedication to improving your financial situation.

Once you have completed the challenge and saved a significant amount of money, it’s time to reward yourself for your efforts. Here are some ideas for treating yourself:

Reward Ideas

- Treat yourself to a nice dinner at your favorite restaurant.

- Plan a weekend getaway or a short vacation to relax and recharge.

- Buy something you’ve been wanting for a while, whether it’s a new gadget, a piece of clothing, or a book.

- Pamper yourself with a spa day or a massage.

- Invest in a hobby or activity that brings you joy, such as art supplies, sports equipment, or cooking classes.

Remember, the reward should be something that brings you happiness without compromising your financial progress. It’s important to find a balance between treating yourself and staying on track with your financial goals.

Next Steps

Completing the 100 Envelope Challenge is a significant accomplishment, but it shouldn’t stop there. Here are some next steps you can take to continue improving your financial habits:

- Evaluate your spending habits and identify areas where you can make further improvements.

- Create a budget to help you manage your expenses and save even more money.

- Consider exploring other saving challenges or financial goals to continue building your savings.

- Educate yourself about personal finance through books, podcasts, or online resources to expand your knowledge and make informed financial decisions.

- Set long-term financial goals and create a plan to achieve them, whether it’s saving for a down payment on a house or starting a retirement fund.

By continuing to prioritize your financial well-being and making conscious decisions about your money, you can achieve long-term financial success and build a secure future.